north carolina estate tax certification

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. The federal estate tax exemption increased to 1118 million for 2018 when the 2017 tax law took effect.

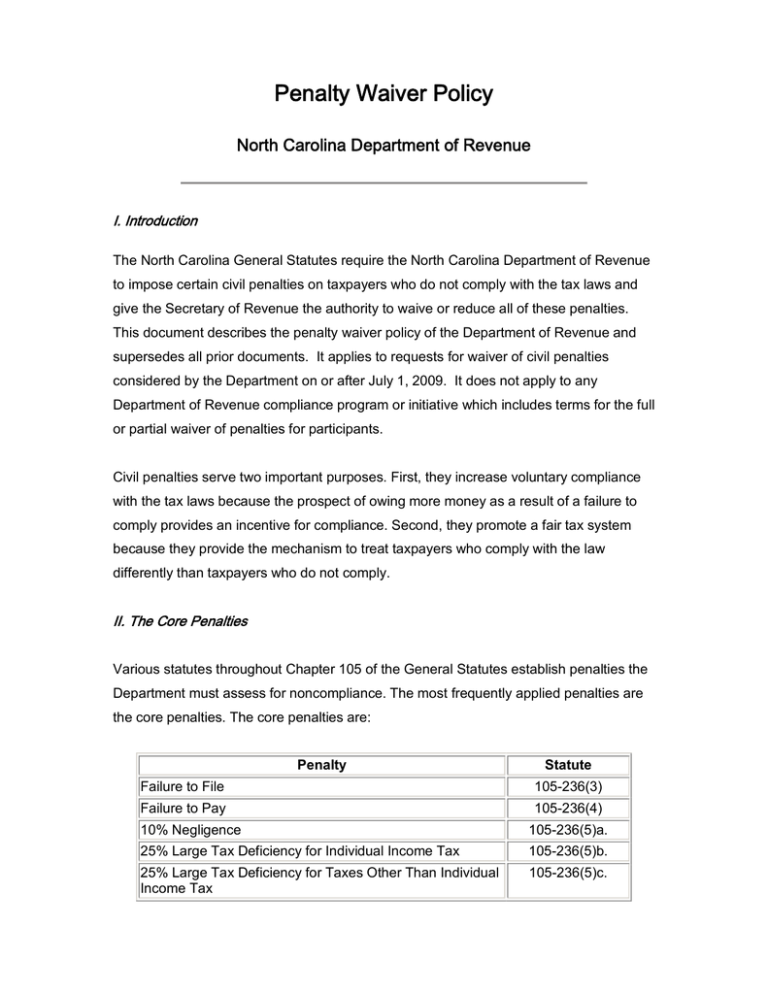

Penalty Waiver Policy North Carolina Department Of Revenue

Once certified by the Veterans.

. 251 North Main Street Room 190. The North Carolina County reviewing the tax status of the estate must be reported along with the file. The Tax Certification Program Rules have been readopted with changes effective March 1 2021.

Estate Tax Certification 87 North Carolina County Information. To be a certified assessor the provisions of NCGS 105-294 must be met. Free Preview North Carolina Estate Tax.

Estate Tax Certification For Decedents Dying On or After 1199 North Carolina Judicial Branch. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. NC K-1 Supplemental Schedule.

15A NCAC 13B Section 1500. Mail or Fax Certification to. At least 72 hours of CLE credits in estate planning and related fields.

Additional information can be found on the North. However the State of North Carolina is not one of those states. Eligible - Has met NCDOR educational requirements for assessor and is qualified for the position but.

Instant access to fillable Microsoft Word or PDF forms. The tax rate is 200 per 1000 of the. AAll official court forms are reproduced by permission of the North Carolina Administrative Office of the Courts.

North Carolina Estate Tax Certification Under 27 ncac 01d section2301 the north carolina state bar board of legal specialization established estate planning and probate law as. Beneficiarys Share of North Carolina Income Adjustments and Credits. Deeds must have grantee address affixed on first page for tax billing purposes.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. At least 45 hours shall be in estate planning and probate law provided however that eight of the 45 hours may be in the. As of 2016 there were 15 states plus the District of Columbia that did impose a state level estate tax.

As of March 1 2019 the Davidson County Tax Department has implemented the Tax Certification requirements per North Carolina General Statute 161-31 and the resolution adopted by the. Real Estate Checklist Tax. Estate Tax Certification For Decedents Dying On Or After 1 1 99 E-212 Start Your Free Trial 1399.

The grantor must pay the Real Estate Excise Tax at the time of recording. E-212 Estate Tax Certification for decedents dying on or after. Find COVID-19 orders updates and FAQs.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. 28A-21-2a1 is not required for a decedent who died on or after 112013. Estate Tax Certification For Decedents Dying On Or After 1199.

North Carolina Judicial Branch Search Menu Search. Including real property located outside North Carolina at the time of the. Find a courthouse Find my court date Pay my citation online Prepare for jury service.

In the matter of the estate of state of north carolina county note. The NC Home Advantage Tax Credit could make your new homes an attractive option for first-time buyers those who havent owned a home as their principal residence in the past three. The certification program shall be available.

The Leading Online Publisher of National and State-specific Legal Documents. Requirements for Certification by the North Carolina Tax Collectors Association Revised May 9 2012 A. An estate tax certification under GS.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. This is an official form from the North Carolina Administration of the Courts. An Estate Tax Certification Form No.

Estate tax certification north carolina the taxes by way of you and theyll do anything to prisonly finish the identical job including seizing your on-line business and individualal assets. North carolina law requires the department of revenue to provide a certification and continuing education program for county assessors and. Inheritance And Estate Tax Certification - Decendents Prior to 1-1-99.

AOC-E 212 OR an Inheritance and Estate Tax Certificate issued by the North Carolina Department of Revenue will need to be completed by the time. For assistance or to acquire a copy of the tax certification form contact the Alleghany County Tax Office at 336-372-8291. This is an official form from the North Carolina Administration of the Courts AOC which complies with.

Owner or Beneficiarys Share of NC.

The Ultimate Guide To North Carolina Real Estate Taxes

North Carolina Sales Tax Small Business Guide Truic

North Carolina Estate Tax Everything You Need To Know Smartasset

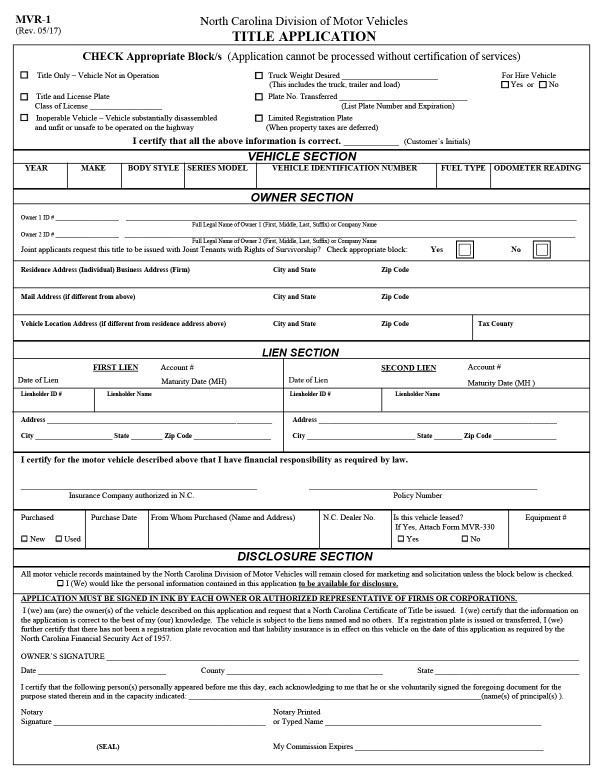

Special Power Of Attorney Form Unique Limited Power Of Attorney Motor Vehicle Transactions Power Of Attorney Power Of Attorney Form Job Application Template

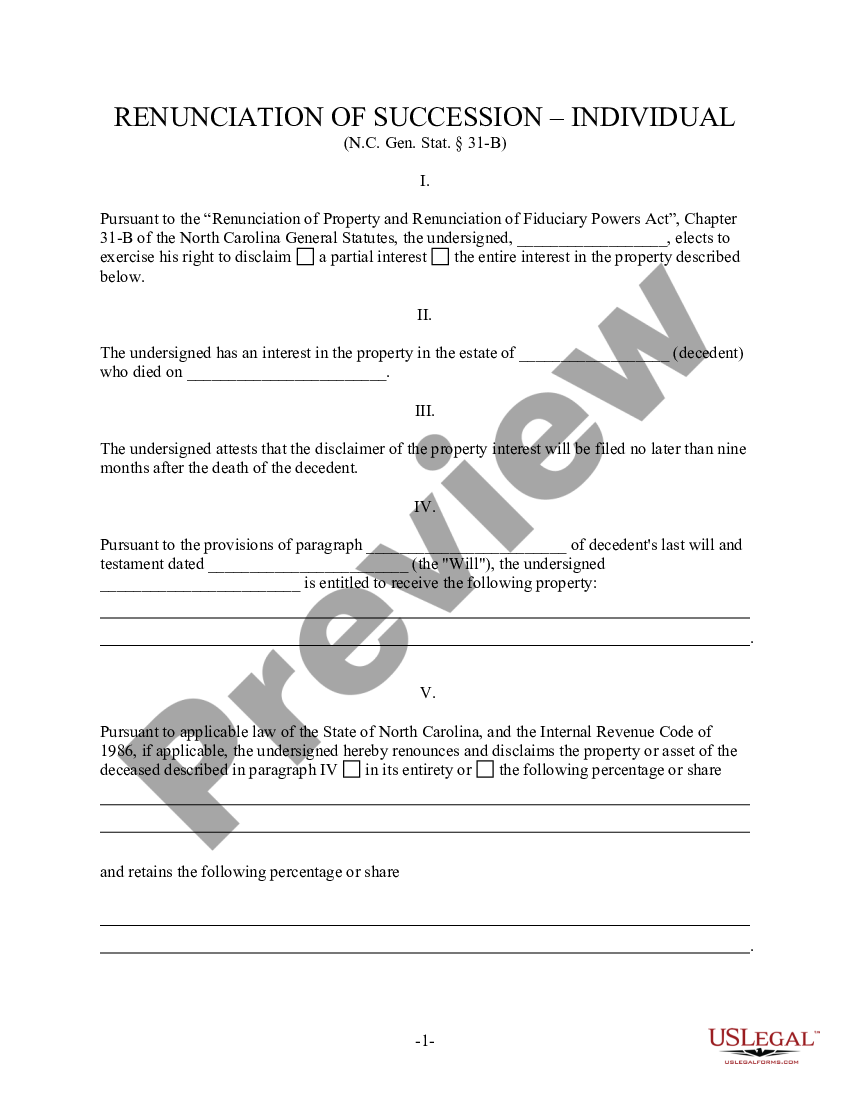

North Carolina Renunciation And Disclaimer Of Property From Will By Testate Renunciation Of Inheritance Form Nc Us Legal Forms

North Carolina Estate Tax Everything You Need To Know Smartasset

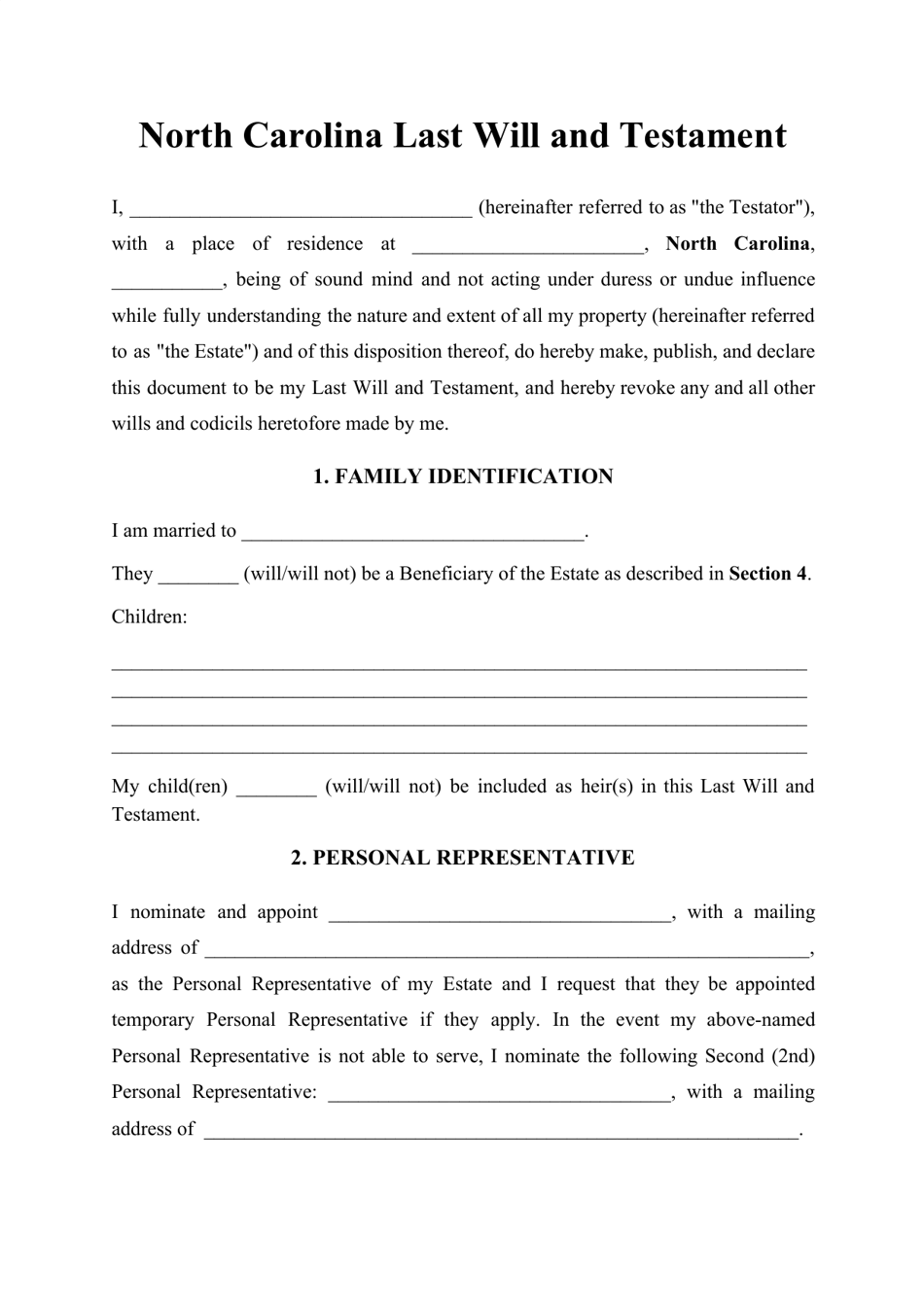

North Carolina Last Will And Testament Template Download Printable Pdf Templateroller

North Carolina Bill Of Sale Pdf Templates Jotform

North Carolina Real Estate Commission Rules Chapter 93a State Publications I North Carolina Digital Collections

Free North Carolina Name Change Forms How To Change Your Name In Nc Pdf Eforms

North Carolina Last Will And Testament Legalzoom Com

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Nc Car Sales Tax Everything You Need To Know

North Carolina Quit Claim Deed Form Quites North Carolina Words

All About Bills Of Sale In North Carolina The Forms Facts You Need

Room Rental Agreement Template Real Estate Forms Rental Agreement Templates Room Rental Agreement Real Estate Forms

North Carolina Use Tax Changes Use Tax Consulting

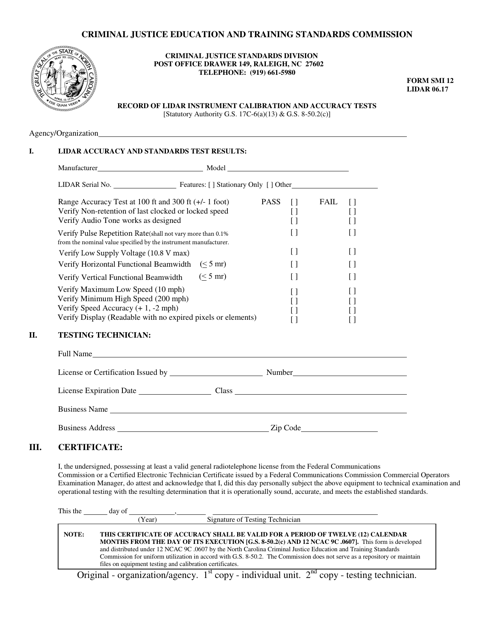

Form Smi12 Download Printable Pdf Or Fill Online Record Of Lidar Instrument Calibration And Accuracy Tests North Carolina Templateroller

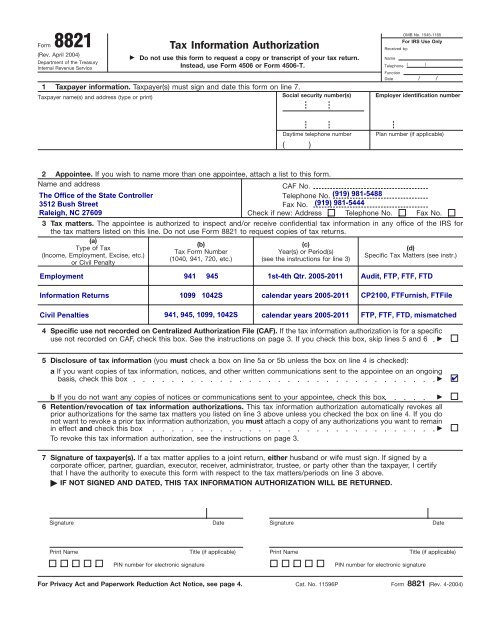

Irs Form 8821 Tax Information Authorization North Carolina Office